Contents

01

Executive Summary

- Fun Features

- Monetization

- Top Monetization Networks

- User Acquisition

- UA Strategy

- Creative Strategy

02

Game Overview

- Gameplay

- Fun Features

- Monetization

- In-App Purchases

03

User Acquisition

- Revenue + Revenue in Top Tier-1 Countries

- Downloads + Downloads in Top Tier-1 Countries

- Monetization Networks

04

Top Creatives

05

Top Creatives (Competitors)

06

User Acquisition Strategy

07

Creative Strategy

08

Slotomania Strategy

Executive Summary

Fun Features:

Daily Dash Rewards

Social Gifting

Exclusive Event Bonuses

Special PvE modes/levels

Progressive jackpot

Monetization

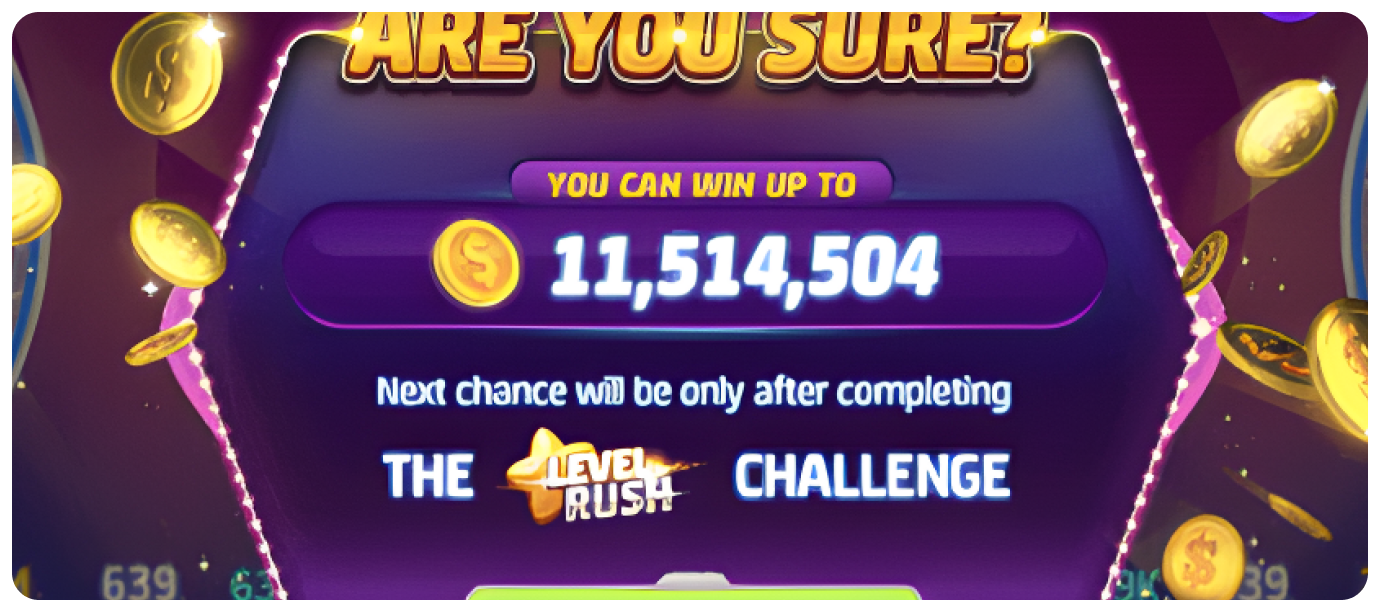

First paywall Within 10 minutes

Second Offer Within 30 minutes (First Dash offer)

Mini-game Offer Within 5 hours

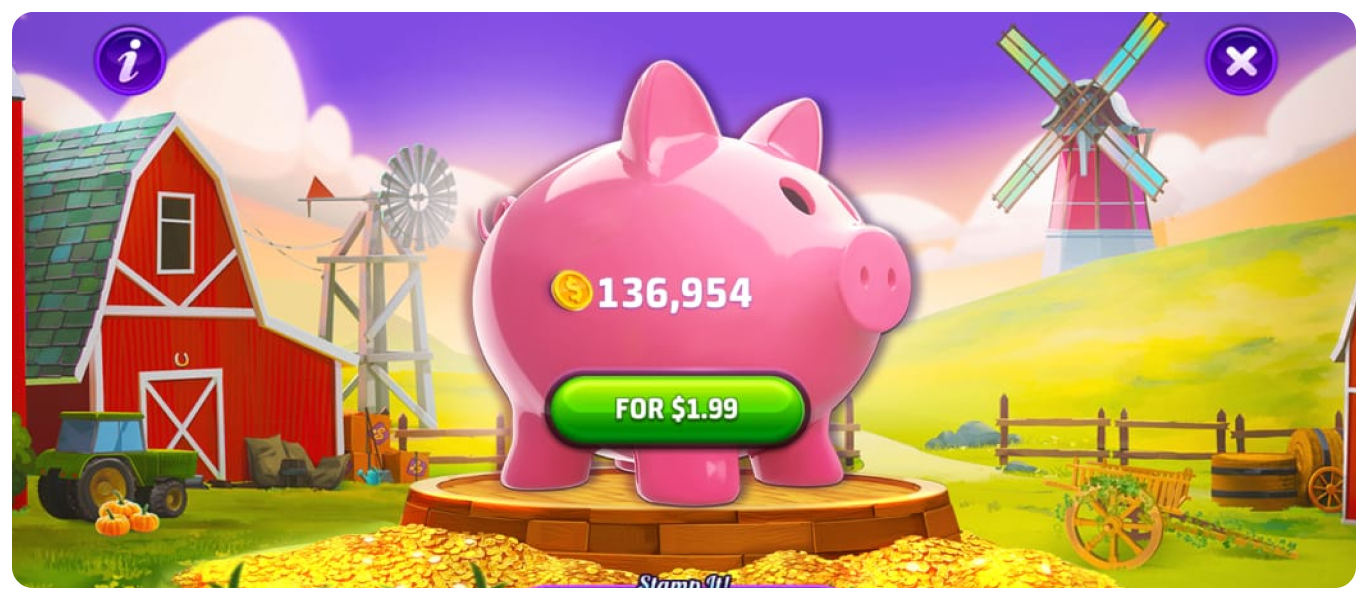

Break Piggy Bank Offer Within 28 hours

Piggy Bank Offer on level 45

Golden Spin Within 50 hours

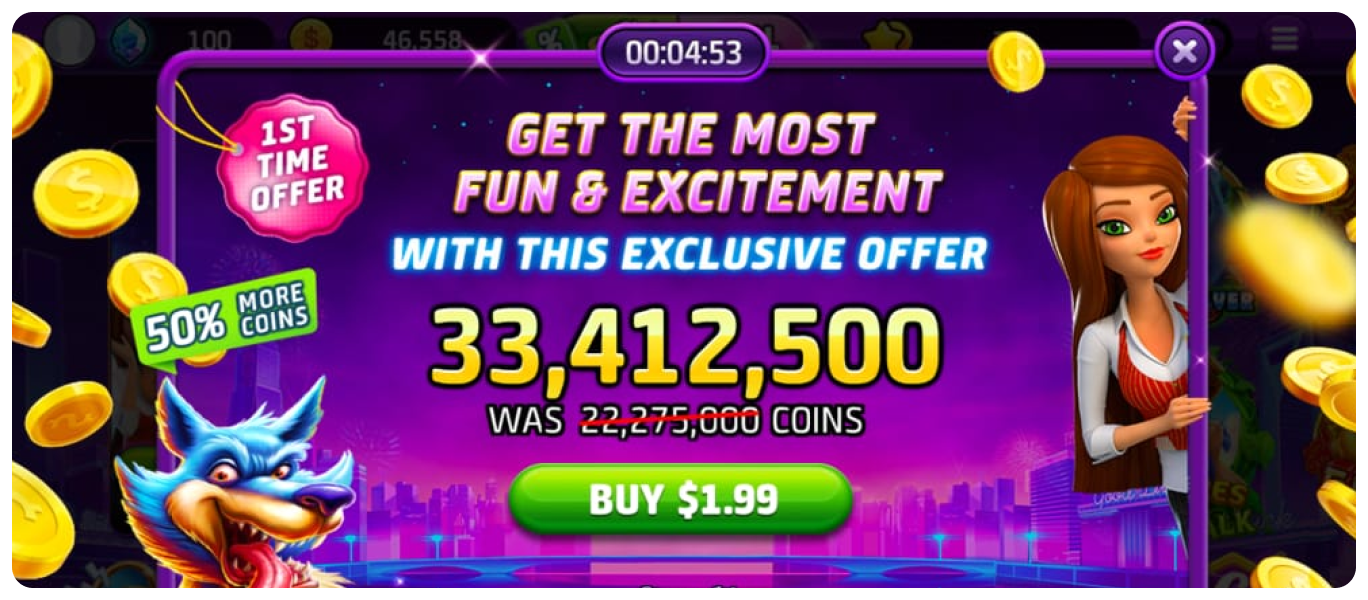

One-time offer Within 65 hours

Top Monetization Networks

User Acquisition

Revenue of $2,067,484,079

Top five countries in revenue: USA, Australia, UK, Canada, and Germany.

Total downloads of 76,416,863.

Top five countries in downloads: USA, UK, Australia, Canada, and France.

UA Strategy

Downloads: While there has been a recent decline of 4.87% in downloads, the overall trend shows a positive growth of 4.28% over the last 60 to 90 days. This indicates a need to evaluate and adjust user acquisition strategies to maintain consistent growth.

Revenue: Revenue has experienced a slight decrease of 0.73% in the last 14 days. However, the overall trend shows a positive growth of 3.5% over the last 60 to 90 days. This highlights the need for ongoing optimization of monetization strategies to sustain revenue growth.

Monetization Networks: The increase in Unity's share by 13% in the last 14 days suggests a strategic shift towards leveraging this network. Fluctuations in Ironsource, Facebook, and Fyber's shares indicate a strategy of diversifying monetization options to maximize revenue potential.

Popular Markets: The significant increase of 16.3% in the US market indicates successful user acquisition and marketing strategies in this region. Growth in the UK and Australian markets reflects targeted efforts to cater to player preferences. The decline in the Canadian market highlights the need for adjustments in strategies to regain traction and attract new players.

Creative Strategy

Unique/New Creatives: Recent decline (-16.4%) indicates a shift in creative strategy. Overall growth (+6.30%) suggests ongoing efforts to generate fresh content.

Monetization Networks: Unity shows strong growth (+16.8%), and Fyber and Facebook decrease (-2.5% and -4.1%). AdMob sees notable growth (+10.6% and +22%), maximizing revenue potential.

Popular Markets: USA remains strong, and Australia and UK show consistent growth. Canada exhibits notable growth. Continued focus is needed in key markets.

Slotomania is an engaging and popular online casino game that offers an exhilarating virtual slot machine experience. Developed by Playtika, it boasts a vast collection of themed slot games, stunning graphics, and immersive gameplay. With its vibrant visuals, abundant bonus features, and social interactions, Slotomania delivers an entertaining and addictive gaming experience to millions of players worldwide.

Gameplay

The core gameplay involves spinning the reels by tapping the spin button (with an option of auto spin), revealing various symbols and winning combinations.

A progression system and achievements in Slotomania motivate players to unlock new levels, access higher-stakes machines, and earn rewards.

Slotomania offers a wide variety of over 170 unique slot machines, each with captivating visuals and immersive audio, featuring themes ranging from classic to adventure, fantasy, and pop culture-inspired slots.

Multiple pay lines are available on each slot machine, allowing players to customize their betting strategy by choosing the number of active pay lines and adjusting their bet sizes.

Social interaction is a crucial aspect of Slotomania, enabling players to connect with friends, compete in tournaments, exchange gifts, and engage in friendly competition on leaderboards.

Bonus features and mini-games in Slotomania, such as free spins, wild symbols, scatter symbols, and interactive mini-games, provide additional excitement and opportunities for players to win prizes.

Fun Features:

Daily Dash Rewards

Social Gifting

Exclusive Event Bonuses

Special PvE modes/levels

Progressive jackpot

Monetization

Monetization Strategy: Slotomania

1. First paywall (Within 10 mins)

Once users claim their free rewards and spin the slot machine 7-8 times, an in-app purchase (IAP) offer will appear on their screen.

The game features a first-time special offer that claims to be discounted from $2.99 to $25.

2. Second Offer (Within 30 mins)

The Daily Dash feature offers players a monetization opportunity with rewards for completing daily objectives.

Slotomania introduces a Dash season, resembling a battle pass system, with both free and premium versions available.

Participating in the Dash season allows players to unlock additional rewards and benefits, enhancing their gameplay experience.

Slotomania offers a premium version of the Dash season called Dash Max, which provides additional rewards.

Priced at $4.99, Dash Max follows the standard pricing model for battle pass features in similar games.

Slotomania strategically introduces Dash Max early in players' journey to hook them with enticing extra rewards from the very beginning. The game aims to capitalize on players' growing appetites for rewards, potentially leading to in-game purchases.

3. Mini-game offer (Within 5 hours)

Slotomania features a level road called Slotocity that unlocks new in-game features as players progress.

Players can unlock the Ballinko mini-game during their gameplay sessions, offering the opportunity to claim rewards.

The game presents players with the option to play Ballinko again for larger prizes at $2.99, targeting engaged gamblers who enjoy luck-based features.

4. Break Piggy Bank offer (Within 28 hours)

Slotomania introduces the Piggy Bank feature on the Slotocity road, allowing players to collect savings as they spin the slot machine.

The piggy bank gradually fills up with coins as players continue to play, and they have the option to break the piggy bank at any time for a fixed price of $2.99.

This purchase becomes enticing to players due to psychological factors. They develop a sense of attachment to the piggy bank because they contribute their effort and time to fill it up.

5. Piggy Bank offer (on level 45)

Upon reaching level 45, players are presented with an enticing opportunity on the Slotocity road - the chance to acquire the piggy bank for free.

By receiving over 500k coins without any monetary investment, players can experience firsthand the value and benefits of the piggy bank feature. This strategic approach aims to create a sense of appreciation and potentially engage players further.

6. Golden Spin (within 50 hours)

The home screen showcases the enticing "Collect mega bonus" feature, resembling a traditional wheel of fortune.

While the initial spin grants players free rewards, subsequent spins require a purchase of $1.99.

This monetization approach primarily targets engaged gamblers, offering them the chance to extend their thrilling gameplay experience for a nominal fee.

7. One-time offer (again within 65 hours)

Slotomania presents time-limited IAP offers, such as the generous $40+ worth of coins at $2.99, creating a sense of urgency and enticing players to make an impulse purchase.

As players progress and reach higher levels, the game strategically provides heavily discounted offers to cater to their increasing need for coins, tapping into their engagement and desire for progression.

By devaluing the in-game currency store, Slotomania motivates players to take advantage of discounted deals, leveraging the appeal of significant discounts and the perception of obtaining greater value for their purchases.

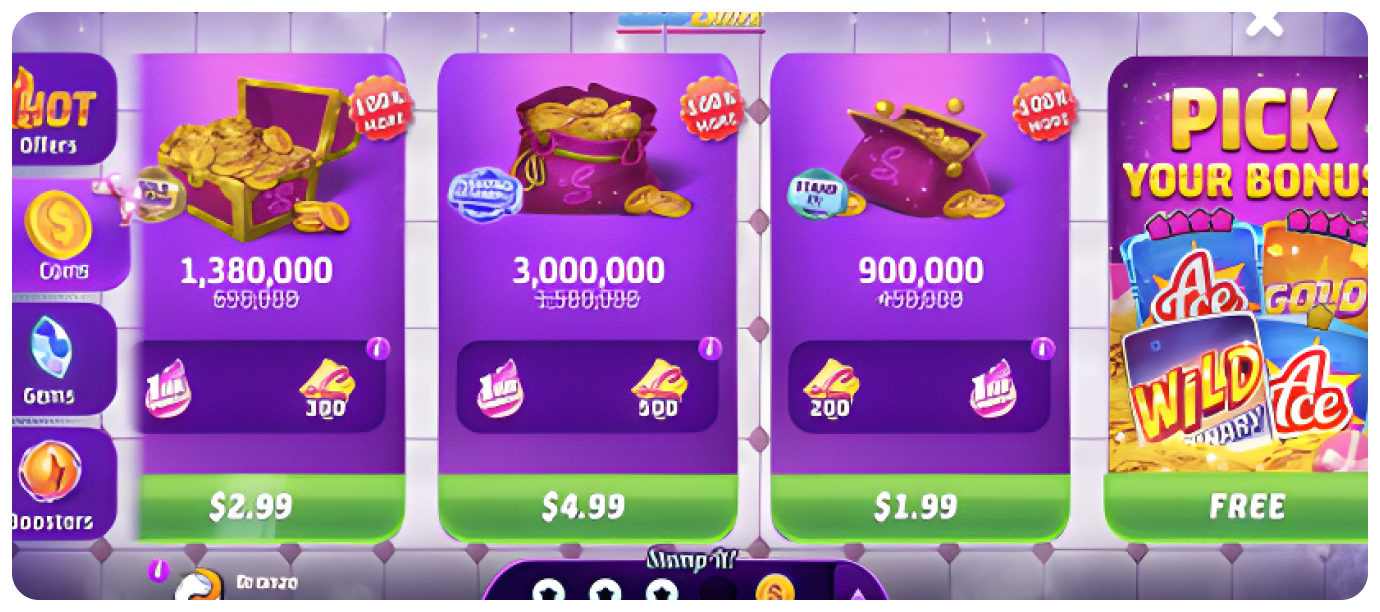

In-game currency

1. Coins

Slotomania offers a range of diverse coin packs, ranging from $1.99 to $49.99, providing players with flexibility in choosing the package that suits their preferences and budget.

New players are treated to a special bonus, receiving 100% more coins with any coin pack purchase. This exclusive offer enhances the sense of value and exclusivity for new players, enticing them to make a purchase and kick-start their gameplay experience.

The variety of coin pack options and the bonus for new players create a sense of choice and personalized experience, catering to different player preferences and increasing the appeal of purchasing coins within the game.

2. Gems

Slotomania offers gems as a secondary in-game currency, catering to the meta layers of the game and providing additional benefits to players.

Gems are available in three different packs, priced between $1.99 and $9.99, offering players flexibility in choosing the pack that aligns with their desired level of investment.

The limited number of gem pack options reflects the understanding that players may be less inclined to spend real money on the game's soft currency, thus providing a more focused selection of offers to cater to their preferences and spending habits.

3. Booster subscriptions

Slotomania provides three booster subscriptions that offer players exclusive benefits for a duration of three or seven days, allowing them to test the subscription features before committing to a longer-term subscription.

The pricing range of $0.99 to $9.99 for gems and subscriptions reflects the understanding that players are more likely to make smaller purchases rather than high-priced ones. This aligns with the player's spending behavior and ensures affordability for a wider audience.

The most popular and best-selling offer in Slotomania is the $1.99 coin pack, indicating that a significant portion of the player base prefers to make smaller purchases when it comes to in-game currency, reinforcing the notion that players are more inclined towards minimal spending.

Top In-App Purchases

User Acquisition

Revenue: $2,067,484,079

Top Countries Tier:1

USA

🇺🇸 (68%) : $1,403,680,839

Australia

🇦🇺 (10%) : $198,070,454

Canada

🇨🇦 (6%) : $121,171,228

UK

🇬🇧 (2%) : $$33,738,810

Germany

🇩🇪 (2%) : $32,358,839

Other Countries:

France 🇫🇷 (27%),

Singapore 🇸🇬 (11%),

Italy 🇮🇹 (11%)

Downloads: 76,416,863

Top Countries Tier:1

USA

🇺🇸 (38%) : 12,162,505

Australia

🇦🇺 (3%) : 1,909,772

UK

🇬🇧 (<3%)

Canada

🇨🇦 (<3%)

France

🇫🇷 (<3%)

Other Countries:

Mexico 🇲🇽, (5%),

Brazil 🇧🇷 (5%)

Italy 🇮🇹 (3%)

Top Monetization Networks (Last 30 days)

.svg)

RpD

Tier-1 West: $48.3

Global: $27.45

Top Creatives

Creative 1

CREATED

Nov 23, 2023

IMPRESSION

6,747,309

Impressions by country

US (99%)

Other countries

N.A

Creative tags

COLORS

Monetization Network:

Creative 2

CREATED

Oct 22, 2023

IMPRESSION

5,510,443

Impressions by country

USA (71%),

Canada (15%),

UK (9%),

Australia (4%),

Germany (1%)

Other countries

N.A

Creative tags

COLORS

Monetization Network:

Creative 3

CREATED

Oct 20, 2023

IMPRESSION

3,274,965

Impressions by country

USA (85%),

Canada (9%),

UK (4%),

Australia (1%)

Other countries

N.A

Creative tags

COLORS

Monetization Network:

Top Creatives (Competitors)

1. Cash Tornado™ Slots - Casino

CREATED

Aug 30, 2024

IMPRESSION

12,541,456

Impressions by country

USA (87%),

Australia (5%),

France (2%)

Other countries

Israel (3%)

Creative tags

COLORS

Monetization Network:

2. DoubleDown™ Casino Vegas Slots

CREATED

Sep 10, 2024

IMPRESSION

2,080,404

Impressions by country

USA (24%),

Canada (14%),

Australia (10%),

France (8%),

UK (7%),

Germany (5%)

Other countries

Mexico (13%),

Italy (4%)

Creative tags

COLORS

Monetization Network:

3. POP! Slots™ Vegas Casino Games

CREATED

Oct 30, 2023

IMPRESSION

70,983

Impressions by country

USA (41%),

Germany (27%),

Australia (22%),

Canada (10%)

Other countries

N.A

Creative tags

COLORS

Monetization Network:

User Acquisition Strategy

Change in %

% change = ((new value - old value) / old value) * 100

How is Strategy changing?

1. Change in Downloads

There is a decline of 4.87% in downloads compared to the previous 14-day period. This indicates a decrease in user acquisition efforts during this specific timeframe. It suggests that the strategies implemented to attract new users may not have been as effective as before.

However, it is essential to consider the broader trend. Despite the recent decline, downloads have shown an overall increase of 4.28% over the last 60 to 90 days. This indicates successful user acquisition strategies implemented during the longer timeframe.

2. Change in Revenue

Revenue has experienced a slight decrease of 0.73% in the last 14 days. This suggests a temporary setback in monetization efforts during this specific period. It implies that the strategies employed to generate revenue may need further refinement or adjustments to maintain consistent growth.

Similar to the downloads, it is crucial to consider the overall trend. Revenue has shown an overall increase of 3.5% over the last 60 to 90 days, indicating a positive growth trajectory. This implies that the adjustments made in the monetization strategies during the longer period have been fruitful.

3. Change in Monetization Networks

The increase in the share of Unity by 13% in the last 14 days indicates a strategic shift towards leveraging this monetization network. This suggests that the game developers identified the potential benefits of Unity and focused on integrating it more prominently into the game.

Ironsource, Facebook, and Fyber's fluctuating shares over different periods suggest a willingness to experiment with various monetization networks. This indicates a strategy of diversifying the monetization options to maximize revenue potential and find the most effective network for the game.

4. Change in Popular Markets

The strong increase of 16.3% in the US market in the last 14 days highlights the success of user acquisition and marketing strategies in this region. It suggests that the game resonates well with the US audience, leading to a higher influx of downloads and potentially higher revenue.

The growth in the UK and Australian markets in the last 14 days indicates successful targeting and user acquisition efforts in these regions. This suggests that specific strategies were implemented to cater to the preferences and interests of players in these markets.

The decline in the Canadian market by 4.5% in the last 14 days suggests a potential need for adjustments in the user acquisition and marketing strategies in this region to re-engage players and attract new ones.

Creative Strategy

Change in %

% change = ((new value - old value) / old value) * 100

How is Strategy changing?

1. Change in Unique/New Creatives

The recent trend shows a decline in the production of new creatives. Over the last 14 days compared to the previous 30 days, there was a decrease of 16.4%. This indicates a potential shift in the creative strategy, with fewer new assets being introduced during this period.

However, looking at the broader picture, there has been an overall growth in the creation of unique/new creatives over the past 60 days compared to the preceding 90 days, with an increase of 6.30%. This suggests a continuous effort to generate fresh content, although at a more modest rate.

2. Change in Monetization Networks

Unity has emerged as a strong performer in the monetization network, experiencing significant growth in the last 14 days (+16.8%) and maintaining a consistent presence over the past 30 and 60 days. This indicates a strategic emphasis on leveraging Unity's capabilities to drive monetization.

Fyber, on the other hand, witnessed a decline in its network share during the last 14 days (-2.5%). This could signify a reevaluation of the partnership with Fyber or a shift in focus toward other monetization channels.

Facebook's network share also decreased during the last 14 days (-4.1%), suggesting a potential realignment of advertising strategies or prioritization of alternative platforms.

AdMob experienced notable growth in the last 14 days (+10.6%) and 30 days (+22%). This indicates a concerted effort to maximize revenue through the AdMob network, likely driven by its effectiveness in reaching and engaging users.

3. Change in Popular Markets

The US market has consistently shown strong performance, with notable increases in popularity. Over the last 30 days compared to the previous 60 days, the US market witnessed a growth rate of 2.6%. However, there was a slight decline in popularity during the last 60 days compared to the preceding 90 days (-1.3%). This suggests the need for continued focus and innovation to maintain and expand the user base in this key market.

Australia and the UK have shown consistent growth, indicating successful user acquisition and engagement strategies. Australia experienced significant popularity gains during the last 14 days (+26.3%) and continued growth in the previous 30 and 60 days. The UK market demonstrated an impressive increase of 30% in the last 14 days and maintained positive growth in subsequent periods.

Canada exhibited noteworthy growth in popularity during the last 30 days compared to the previous 60 days (+17%). This signals an emerging market with the potential for further expansion and monetization opportunities.

Push Notifications

Slotomania introduces Family Feud-themed creatives, featuring host Steve Harvey, to enhance the game experience.

The inclusion of Steve Harvey's in-app avatar adds familiarity and fun to Slotomania, creating a deeper connection with players.

Gameplay elements inspired by Family Feud, such as a themed slot machine, the Family Feud Super Cup competition, exclusive chat stickers, and themed mini-games, contribute to an immersive and entertaining experience.

These Family Feud-themed creatives aim to engage players and provide a unique twist to the Slotomania gameplay, attracting both fans of the game show and existing Slotomania players.