Contents

01

Executive Summary

- Fun Features

- Monetization

- Top Monetization Networks

- User Acquisition

- UA Strategy

- Creative Strategy

02

App Overview

- Core Functionality

- Fun Features

- Monetization

- In-App Purchases

03

User Acquisition

- Revenue + Revenue in Top Tier-1 Countries

- Downloads + Downloads in Top Tier-1 Countries

- Monetization Networks

04

Top Creatives

05

Top Creatives (Competitors)

06

User Acquisition Strategy

07

Creative Strategy

08

ShutEye Strategy

Executive Summary

Fun Features:

Custom-made Relaxing Sounds

Sleep Calculator

Sleep Stories

Professional Sleep Coach

Printable Calendars

Printable Sleep Tracker

Smart Alarm

Science-backed CBTI program

Monetization

Exclusive Welcome Offer

Premium Access Plan

Spin and Win

Time Limited Offer

Half-Price Deal

Holiday Special Offer

Top Monetization Networks

User Acquisition

Revenue of $35,007,057

Top Tier-1 countries in revenue: USA, UK, Australia, Canada, Germany, France

Total downloads of 24,713,943

Top Tier-1 countries in downloads: USA, UK, France, Canada, Germany, Australia

UA Strategy

Downloads: ShutEye witnessed a 2.1% growth in downloads during the last 14 to 30 days, an 8.8% decrease in the last 30 to 60 days, and a 25.8% increase in downloads over the last 60 to 90 days.

Revenue: ShutEye experienced a 4.4% increase in revenue during the last 14 to 30 days, an 8% rise in the last 30 to 60 days, and a 12.8% growth in revenue over the last 60 to 90 days.

Monetization Networks: Facebook continued to be a top monetization platform during the last 90 days.

Popular Markets: In the last 14 to 30 days, the UK observed a 16.7% increase, while Canada and the USA showed rises of 13.2% and 6.54%, respectively. During the last 30 to 60 days, Australia experienced an 11.2% increase, and Germany exhibited a rise of 6.25%. And, in the last 60 to 90 days, France encountered an 8.1% rise.

Creative Strategy

Unique/New Creatives: In the last 14 to 30 days, there was an 88.4% decrease in new creatives, a 7.2% uptick in the last 30 to 60 days, and a 6% increase over the last 60 to 90 days.

Monetization Network: Facebook continued to be a top monetization platform during the last 90 days.

Popular Markets: In the last 14 to 30 days, France and Germany saw growth of 24.8% and 33%, while the USA experienced a 7.35% decline, and the UK registered a 13.5% increase in the last 30 to 60 days; over the last 60 to 90 days, Germany observed a 7.5% increase, and the USA showed a rise of 5.8%.

The ShutEye app is designed to assist users in enhancing their sleep by monitoring and analyzing sleep patterns. It uses AI algorithms to recognize, calculate, and analyze the files recorded by the user's microphone, providing information about their sleep status. Additionally, the app offers practical suggestions to help enhance sleep habits and overall well-being.

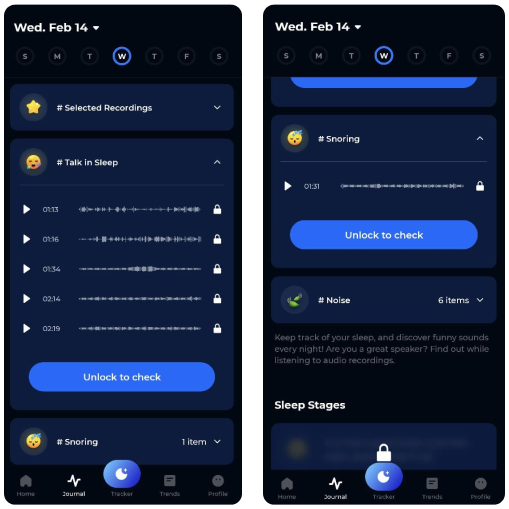

Core Functionality

ShutEye uses device microphones and AI algorithms to track, analyze, and interpret sleep data efficiently.

The app precisely detects and records various sounds, including snoring, sleep talk, teeth grinding, flatulence, and any other sounds generated by the user.

The app provides detailed reports on sleep cycles, durations, interruptions, and schedules, offering personalized suggestions for improvement, such as adjusted bedtimes or environmental modifications, based on individual sleep data.

The application includes guided meditations, white noise soundscapes, and tips for establishing a sleep-friendly environment.

ShutEye aids users in waking up at the optimal moment within their sleep cycle through smart alarms, ensuring they experience a rested and energized feeling.

ShutEye offers an auto-renewing subscription, providing users unlimited access to VIP features, including advanced sleep analysis tools, smart alarms, and more.

Fun Features:

Custom-made Relaxing Sounds

Sleep Calculator

Sleep Stories

Professional Sleep Coach

Printable Calendars

Printable Sleep Tracker

Smart Alarm

Science-backed CBTI program

Monetization

Monetization Strategy: ShutEye

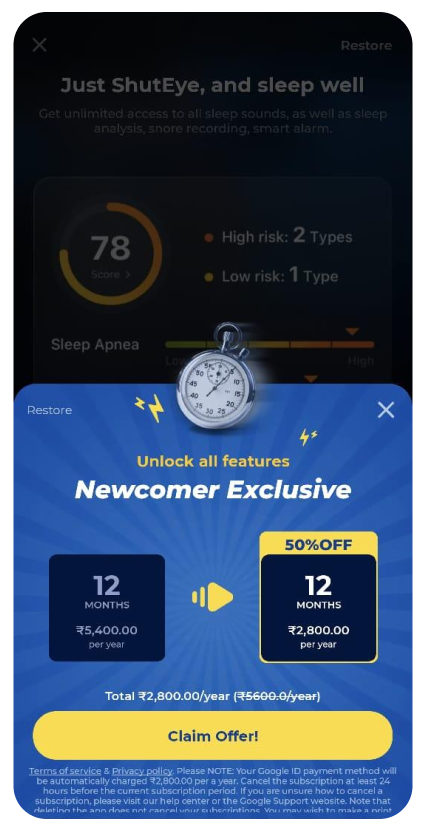

1. Exclusive Welcome Offer

The ‘Newcomer Exclusive’ is about unlocking premium features such as extensive sleep analysis, hundreds of sleep-inducing sounds, and smart alarm functions.

New users are greeted with this special ‘Newcomer Exclusive’ offer after listening to 2 basic sleep stories to capitalize on their initial engagement.

Discounting annual plans (as indicated by the 50% off on the 12-month subscription) encourages longer-term commitments from users, which ensures a steadier revenue stream.

Providing a support channel (shuteye_support@enerjoy.life) within the IAP narrative emphasizes the commitment to service and user satisfaction, increasing trust and subscription uptake.

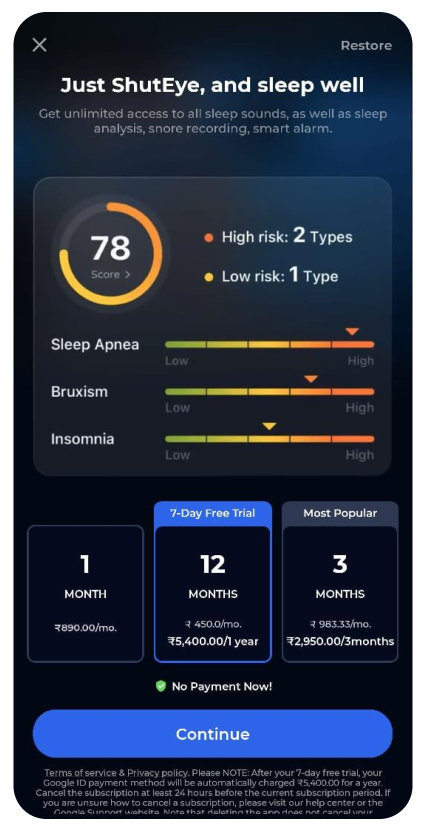

2. Premium Access Plan

The ' Premium Access Plan’, is about a tiered subscription model with a 7-day free trial followed by different durations for subscription plans: 1 month, 12 months, and 3 months.

Users encounter this IAP offer when they attempt to access premium content during the app's usage.

By incorporating a free trial period, the app hooks users, demonstrating the app's value before asking for payment. This encourages higher conversion rates from free to paying users.

Each offering of this IAP has a stated price, with the annual option being highlighted as the "Most Popular," suggesting a cost-saving benefit over monthly plans.

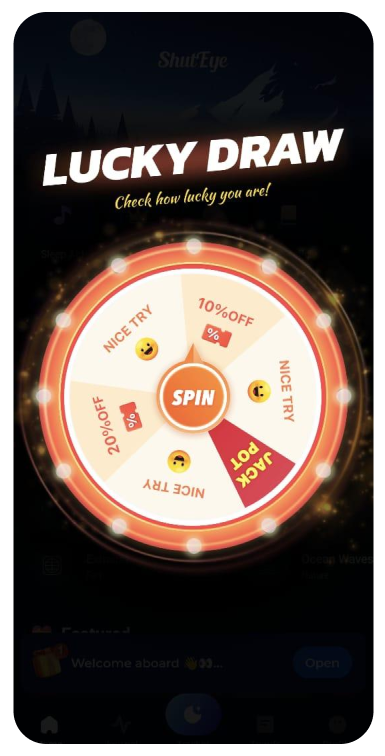

3. Spin and Win

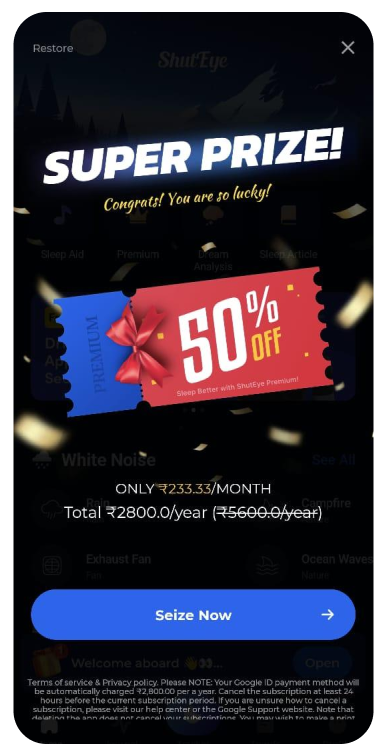

The “Spin and Win” deal offers users a gamified experience to win discounts on app services, including a 'SUPER PRIZE' of 50% off.

The timing of this IAP is every 2 days of continuous app usage and is designed to convert free users into paying customers at a discounted rate.

This gamification incorporates game elements into non-game contexts. By adding the element of fun and creating a sense of luck and reward, the platform increases IAP conversions.

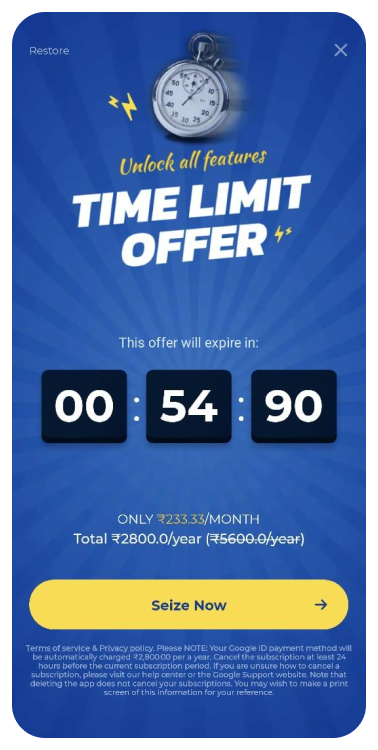

4. Time Limited Offer

The deal features a countdown timer, labeled as a ‘TIME LIMIT OFFER’, motivating users to act quickly to access all features.

The promotion showcases an exclusive annual subscription rate of ₹233.33 per month, a saving from the usual ₹5600 per annum.

This IAP leverages user engagement periods to maximize revenue, employing a data-driven approach to offer premium features when users are most active and interested

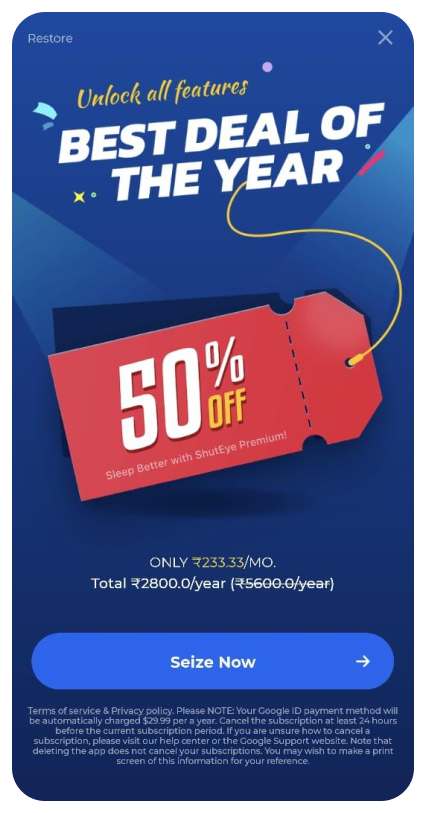

5. Half-Price Deal

‘Half Price Deal’ offers a 50% discount, branding it as the ‘BEST DEAL OF THE YEAR’, providing the highest value for money within the app's subscription plans.

This standout offer is timed after enjoying 4 sleep sessions on the platform. Users can also expect to see the offer during sales periods or when the app is looking to boost year-end revenue figures.

The deal serves as an example of leveraging time-sensitive promotion to drive conversions.

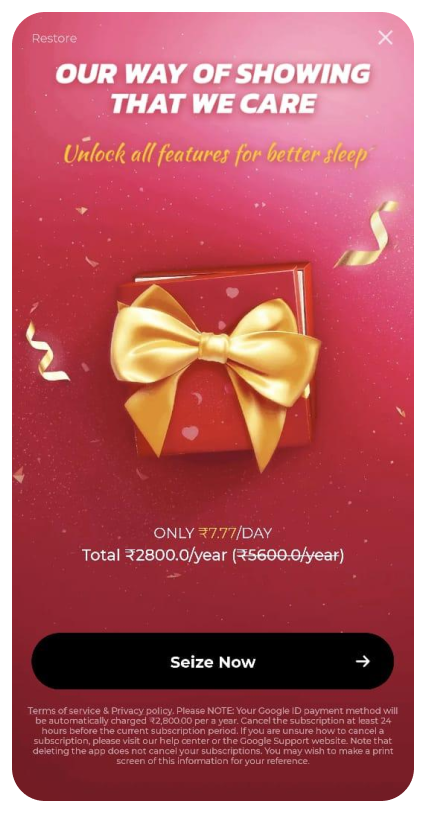

6. Holiday Special Offer

The ‘Holiday Special’ deal presents a caring gesture. By stating ‘Our way of showing that we care’, the deal unlocks all features for better sleep, directly tying the purchase to a tangible benefit.

The offer is timed after 3 to 4 days of continuous usage.

Pricing is presented both on a micro (daily) and macro (annual) scale, making the cost appear more digestible at ₹7.77/day while also transparently showing the annual total. This dual presentation caters to different user preferences, leading to a higher conversion rate.

The strategy behind this IAP offer leverages emotional appeal and the psychology of care. By presenting the offer as a gift or a token of appreciation, it is likely to resonate with users on an emotional level.

Subscription Model of ShutEye

ShutEye provides a basic version of the app at no cost, allowing users to explore initial features and gain insights into their sleep patterns.

For those seeking in-depth analysis and full access to features, ShutEye offers a VIP subscription model. The subscription is available at $9.99 per month or $59.99 per year, catering to different user commitment levels.

New users can take advantage of a 7-night free premium subscription trial.

Solo sleepers who have a habit of snoring and are suffering from sleep apnea concerns can get a subscription plan to analyze their sleep patterns. They can get access to AI-powered sleep tracking, sleep score, sound recording, smart alarm, sleep-aiding bedtime stories, and dream analysis.

Top In-App Purchases

User Acquisition

Revenue: $35,007,057

Top Countries Tier:1

USA

🇺🇸 (66%) : $22,878,982

UK

🇬🇧 (7%) : $2,284,138

Australia

🇦🇺 (6%) : $1,954,493

Canada

🇨🇦 (5%) : $1,617,497

Germany

🇩🇪 (3%) : $951,952

France

🇫🇷 (3%) : $1,072,067

Downloads: 24,713,943

Top Countries Tier:1

USA

🇺🇸 (50%) : 12,259,019

UK

🇬🇧 (7%) : 1,831,795

France

🇫🇷 (6%) : 1,402,259

Canada

🇨🇦 (4%) : 945, 823

Germany

🇩🇪 (4%) : 991,691

Australia

🇦🇺 (2%) : 443,062

Other Countries:

Brazil 🇧🇷 (6%),

China 🇨🇳 (4%)

Top Monetization Networks (Last 30 days)

RpD

Tier-1 West: $1.72

Global: $1.42

Top Creatives

Creative 1

CREATED

Nov 04, 2023

IMPRESSION

2,136,438

Impressions by country

USA (40%),

UK (12%),

Canada (9%),

France (8%),

Germany (6%),

Australia (6%)

Other countries

Switzerland (3%),

Hong Kong (2%)

Creative tags

COLORS

Monetization Network:

Creative 2

CREATED

Oct 13, 2023

IMPRESSION

1,843,272

Impressions by country

USA (36%),

UK (13%),

Canada (10%),

France (8%),

Australia (6%),

Germany (6%)

Other countries

Switzerland (4%),

Brazil (2%)

Creative tags

COLORS

Monetization Network:

Creative 3

CREATED

Nov 04, 2023

IMPRESSION

1,590,814

Impressions by country

USA (36%),

UK (13%),

Canada (10%),

France (8%),

Australia (6%),

Germany (5%)

Other countries

Switzerland (4%),

Brazil (3%)

Creative tags

COLORS

Monetization Network:

Top Creatives (Competitors)

1. Calm

CREATED

Oct 18, 2023

IMPRESSION

4,006,544

Impressions by country

France (35%),

UK (31%),

Germany (11%),

Australia (7%),

Canada (7%),

USA (2%)

Other countries

Netherlands (3%),

Finland (2%)

Creative tags

COLORS

Monetization Network:

2. BetterSleep

CREATED

Dec 17, 2023

IMPRESSION

1,649,915

Impressions by country

USA (100%)

Other countries

N.A.

Creative tags

COLORS

Monetization Network:

3. Hallow

CREATED

Oct 04, 2023

IMPRESSION

3,029,477

Impressions by country

USA (41%),

France (12%),

UK (6%),

Canada (3%),

Australia (2%)

Other countries

Brazil (14%),

Spain (11%)

Creative tags

COLORS

Monetization Network:

User Acquisition Strategy

Change in %

% change = ((new value - old value) / old value) * 100

How is Strategy changing?

1. Change in Downloads

In the last 14 to 30 days, there was a 2.1% rise in downloads.

Over the last 30 to 60 days, a decrease of 8.8% was observed.

In the last 60 to 90 days, downloads showed an increase of 25.8%.

2. Change in Revenue

Over the last 14 to 30 days, the revenue experienced a 4.4% rise.

In the last 30 to 60 days, there was an 8% increase in revenue.

In the last 60 to 90 days, there was an increase of 12.8% in revenue.

3. Change in Monetization Networks

Facebook continued to be a top monetization platform during the last 90 days.

4. Change in Popular Markets

In the last 14 to 30 days, France experienced a growth of 23.3%, the United Kingdom saw an increase of 16.7%, while Canada and the USA showed a rise of 13.2% and 6.54%, respectively.

Over the last 30 to 60 days, the USA demonstrated a growth of 9.4%, Australia experienced an increase of 11.2%, and Germany exhibited a rise of 6.25%.

In the last 60 to 90 days, Germany and Australia both observed a 3.3% increase, France encountered an 8.1% rise and both the UK and Canada experienced a 6.4% increase, while the USA witnessed a growth of 3.75%.

Creative Strategy

Change in %

% change = ((new value - old value) / old value) * 100

How is Strategy changing?

1. Change in Unique/New Creatives

In the last 14 to 30 days, an 88.4% decrease was observed in the new creatives.

Over the last 30 to 60 days, the new creatives had an uptick of 7.2%.

There was a 6% increase in the new creatives in the last 60 to 90 days.

2. Change in Monetization Networks

Facebook remained a leading monetization platform over the last 90 days.

3. Change in Popular Markets

In the last 14 to 30 days, France witnessed a growth of 24.8%, and Germany demonstrated a rise of 33%.

During the last 30 to 60 days, the USA experienced a decline of 7.35%, while France and the UK registered increases of 18.4% and 13.5%, respectively.

In the last 60 to 90 days, Germany observed an increase of 7.5%, the USA showed a rise of 5.8%, and the UK demonstrated an increase of 6.6%.

Push Notifications

ShuyEye sends 1 to 2 daily push notifications, providing reminders to upgrade to premium, unlock new sleep sounds, and more, enriching user's sleep experiences.

ShutEye enhances user engagement by refining notifications based on individual preferences, sleep patterns, and meditation routines, customizing each message, and incorporating the user's name for a more personalized and engaging experience.

To promote app usage, ShutEye notifications feature calls-to-action like “Upgrade to Premium”, guiding users toward decisive steps to enhance their overall experience.

The ShutEye app keeps users informed about new content, including guided meditations, Sleepedia, and sleep-enhancing tips through notifications, offering a range of options to sustain their interest in the app over time.